Blog

Green Bonds In International Capital Markets

Blog

June 12, 2024

Over the last two decades, sustainability has become a mainstream global concern, shaping innovative financial instruments (in the form of loans and debt securities) that integrate environmental, social, and corporate governance (ESG) factors with broader considerations for long-term economic sustainability, collectively defined as sustainable finance. This new landscape presents opportunities to finance ESG projects, particularly in Latin America and other developing regions, as the United Nations estimates that developing countries will need nearly US$6 trillion by 2030 to achieve their greenhouse gas emission reduction targets.

GSSS Bonds in International Capital Markets

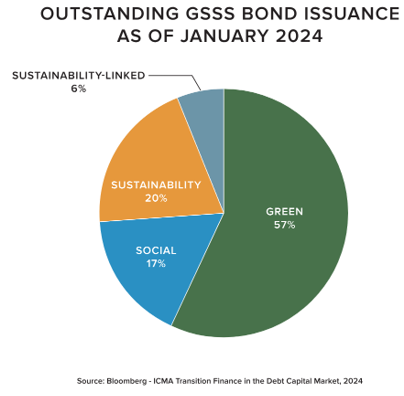

Within sustainable finance, the adoption of green, social, sustainability, and sustainability-linked (GSSS) bonds in the international capital markets has grown rapidly. GSSS bonds share the same financial characteristics as conventional bonds, but the key distinction lies in their alignment with various ESG goals and frameworks or principles.

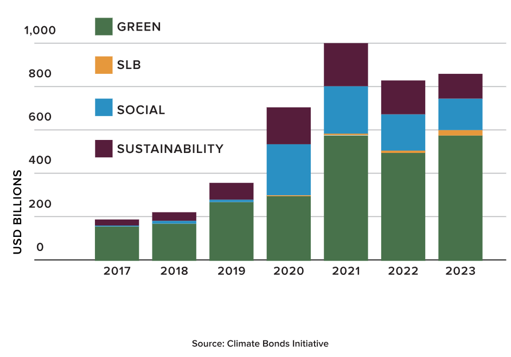

With investors increasingly prioritizing ESG investments, market demand for GSSS bonds has increased dramatically, with GSSS bonds reaching consistent annual issuances of over US$800 billion per year for three consecutive years (2021-2023). From an issuer’s perspective, issuing GSSS bonds offers several benefits, including broadening the investor base and increasing demand, enhancing ESG credentials, potentially reducing the interest rate or cost of capital (the so-called green premium or greenium), and boosting the credibility of its ESG efforts among stakeholders.

In many cases, issuers are already implementing various ESG-related policies, programs, and initiatives, whether as part of their own internal strategies or in response to demands from international, national, or regional authorities, current and potential investors, local communities, or other constituencies. GSSS bonds provide an opportunity to leverage these existing ESG-related activities to take advantage of the benefits of sustainable finance instruments.

GSSS bonds can be used to finance projects in strategic sectors (e.g., transportation, energy, water supply, food security) that align with many issuers’ businesses. Integrating reliable ESG targets and metrics allows issuers to enhance financial performance, create value through proactive environmental risk management, align holistically with stakeholders, and attract new investors seeking sustainable investment options.

GSSS Bonds Categories: Use of Proceeds and Target-Linked Instruments

Within GSSS bonds, there are two principal categories. The first category is use-of-proceeds instruments (UoP Bonds), such as green, social, and sustainability bonds, or any type of bond where the net proceeds are exclusively allocated to finance or refinance, in whole or in part, new and/or existing eligible environmental and social projects, or a combination of both. The second category is target-linked instruments that do not restrict the use of proceeds, but have financial terms, such as interest rates, linked to the achievement of pre-established performance targets based on the issuer’s ESG-based business metrics.

Use of Proceeds (UoP) Bonds - Characterization as Green, Social or Sustainability Bonds

The characterization of a UoP Bond as a green, social or sustainability bond depends on its eligible project categories. For instance, eligible projects under the International Capital Market Association (ICMA) principles include renewable energy, climate change adaptation, clean transportation, food security, housing, gender equality, and education. Regardless of the characterization, UoP Bonds generally share key attributes with respect to use of proceeds, process for project evaluation and selection, management of proceeds, and reporting.

In consultation with its counsel and ESG advisors, an issuer should determine the specific characterization for the UoP Bond, guided by the primary objectives of the underlying projects and the definition of eligible projects (green, social or sustainability) to which proceeds may be allocated. The design and establishment of this framework entails financial planning to anticipate the allocation of proceeds within operational budgets, guided by capital expenditure assumptions and the company’s strategic ESG objectives. Prior to issuance, the issuer engages an external review provider to assess the UoP Bond through a pre-issuance external review of the four key attributes discussed above (the second party opinion).

UoP Bonds also require the periodic publication of ESG reports until all of the net proceeds of the issuance have been fully allocated (post-issuance disclosure). The periodic ESG reports will be accompanied by management certification that an amount equal to the net proceeds of the UoP Bonds has been allocated to eligible green, social or sustainability projects and an attestation report from an independent third party that provides assurance that the proceeds have been allocated consistent with the eligibility criteria for those projects.

Among the UoP Bonds, green bonds are the leading subcategory, accounting for two-thirds of the total amount issued in 2023, and reflecting a 15% year-over-year increase. The market dominance of green bonds can be attributed to the global momentum of energy transition projects, regulatory incentives (e.g., tax benefits or subsidies), support from coalitions of financial institutions, national decarbonization goals, and sustained demand for green sovereign bonds.

Additionally, the widespread market expansion of green bonds has been further enhanced by their structural flexibility. This adaptability not only accommodates a broad range of project categories that are suitable for emerging green technologies but also allows comparability with international and national taxonomies and nomenclatures.

The other two subcategories of UoP Bonds are social bonds and sustainability bonds. Social bonds are specifically used to finance or refinance, in full or in part, new and/or existing eligible social projects (see, for example, the ICMA Social Bonds Principles) with evident social benefits in categories such as basic infrastructure, access to essential services, affordable housing, employment generation, food security, socioeconomic advancement, and targeted populations (e.g., marginalized communities, migrants, or gender minorities). Sustainability bonds are used to finance or refinance a mix of both green and social projects (see, for example, the ICMA Sustainability Bond Guidelines).

The flexibility offered by sustainability bonds is particularly beneficial for energy companies, which, in addition to investing in eligible green projects, must also navigate complex interactions with local communities around critical natural resources or infrastructure projects.

Sustainability-Linked Bonds

As opposed to UoP Bonds, sustainability-linked bonds (SLBs) permit the use of proceeds for general purposes but integrate measurable, forward-looking sustainability key performance indicators (KPIs) and sustainability performance targets (SPTs) into their financial and/or structural characteristics (see, for example, the ICMA Sustainability-Linked Bond Principles). SLBs are designed with incentives or penalties—such as interest rate step-ups, interest rate step-downs, redemption premiums at maturity, purchasing carbon emission credits, or early redemption—associated with the achievement of SPTs. These targets are based on KPIs critical to the issuer’s business operations and may address any ESG matters, including governance objectives, that are not covered by UoP Bonds.

Understanding the interplay between KPIs and SPTs is essential for achieving a coherent structure for SLBs. As an example, consider an energy company that chooses carbon emissions (measured in metric tons of CO2equivalent per year) as its KPI. Its SPT could be a 25% reduction in carbon emissions by the end of 2030. The KPI provides the metric to measure and monitor the issuer’s progress over time under such defined variable. At the specified target date, the KPI will be used to evaluate whether the SPT has been achieved (trigger event). This trigger event determination will, in turn, impact the financial terms of the SLB (incentive or penalty).

The ICMA principles recommend that, before issuing an SLB, issuers appoint a second-party opinion provider. This pre-issuance second-party opinion has a broader scope when compared to that of UoP Bonds, as it assesses the SLB’s alignment with the ICMA principles and evaluates the reliability of KPIs and the ambition level of SPTs. This process increases the complexity of the SLB structure and typically requires more experience with the KPIs used in the issuer’s ESG commitments, with well-established baselines and internal organizational expertise.

SLBs also differ from UoP Bonds due to their more comprehensive post-closing reporting requirements. Issuers of SLBs are encouraged to publish regular reports, at least annually, to monitor the SPTs beyond the full allocation of net proceeds. Additionally, they must provide independent external verification of their performance against each SPT for each KPI annually and at any target date. This ongoing monitoring entails additional costs and risks, which should be weighed against the potential financial benefits, such as a lower interest rate on remaining coupon payments, if the applicable SPTs are met.

Market Transparency through Taxonomies and ESG Disclosure Rules

A wide spectrum of regional and national ESG taxonomies has been established, each designed with particular objectives, definitions, and prioritized industries or sectors. This mostly voluntary system of ESG classifications often presents complexities, leading to considerable transaction costs for issuers and their stakeholders.

Taxonomies play a pivotal role in the development of the green, social, and sustainability bonds market. They serve as the foundation for market participants, second-party opinion providers and external reviewers to assess the eligibility of activities, assets, and/or project categories for funding through such debt instruments.

Following the wave of regional taxonomies initiated by the European Union in 2020, significant progress was made in July 2023 when the United Nations unveiled the Common Framework of Sustainable Finance Taxonomies for Latin America and the Caribbean. Similarly, in March 2024, the Association of Southeast Asian Nations issued version 3 of the ASEAN taxonomy for sustainable finance. These frameworks act as common building blocks to enhance the comparability of national taxonomies within these regions.

However, achieving full standardization of ESG taxonomies remains unlikely, which can particularly impact investors or issuers operating across diverse jurisdictions. In the near future, multiple taxonomies will continue to be the norm in a market that is vital for addressing urgent climate action. The diverse local and regional objectives, along with varying levels of ESG maturity across countries, present significant hurdles.

Taxonomies have been crucial in the adoption of ESG disclosure rules to ensure the reliable publication of sustainability information. For instance, in January 2023, the Corporate Sustainability Reporting Directive (CSRD) came into effect as an integral part of the European Union’s sustainable finance strategy, alongside the EU Taxonomy. Under the CSRD, if a company claims that its energy projects are sustainable, it must use the EU Taxonomy to substantiate that these projects meet the specified environmental sustainability criteria.

An additional component of ESG disclosure involves providing information about sustainability-related risks and opportunities that could impact an entity’s cash flows. In July 2023, the International Organization of Securities Commissions endorsed the International Sustainability Standards Board’s (ISSB) Standards. Following the guidance, the Brazilian Securities and Exchange Commission adopted the ISSB Standards on a voluntary basis starting in January 2024 to enhance the transparency and comparability of sustainability information, thereby enabling access to international funding sources, with mandatory compliance for publicly held companies beginning in January 2026.

Similarly, in March 2024, the United States Securities and Exchange Commission (SEC) issued its final climate disclosure rules to inform investment and voting decisions through the assessment of climate-related risks and the evaluation of how companies are measuring and responding to those risks. In the final rules, which the SEC has stayed pending several legal challenges, the SEC announced that it will publish a final climate taxonomy before the Inline XBRL tagging compliance date under the rules. This taxonomy will include standard tags covering each new disclosure requirement and elements from third-party taxonomies whenever appropriate, acknowledging the importance of comparability with international standards.

In general, the implementation of disclosure rules may spur a new wave of sustainable finance instruments, particularly SLBs, because (i) issuers will already be actively disclosing ESG data, enabling them to properly select KPIs and calibrate SPTs to be linked to their debt instruments, and (ii) it may reinforce investor confidence as ESG disclosures will be subject to liability for misleading or inadequate reporting.

On the other hand, new mandatory disclosure requirements may pose challenges for traditional practices employed by issuers to mitigate securities law risks. Typically, issuers have relied on detailed risk factors to identify potential deviations from GSSS bonds frameworks and have included forward-looking statements to manage investor expectations. Under these new regulations, both issuers and underwriters may face increased scrutiny of such disclosures from regulators and investors. Allegations of securities fraud could arise from any misrepresentation or omission of material facts related to the purchase or sale of the GSSS bonds. This evolving regulatory landscape could lead to new risk assessments and higher transaction costs associated with GSSS bonds.

Geographic Opportunities: Latin American Region

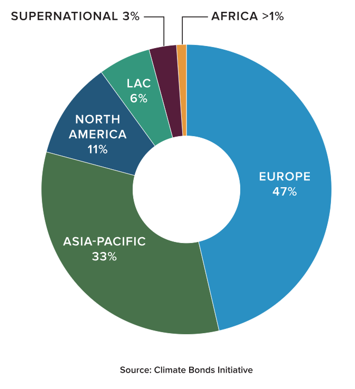

According to the Climate Bonds Initiative, by the end of 2023, the cumulative total of GSSS bonds reached US$4.4 trillion, with 91% of these bonds issued by issuers in Europe, Asia-Pacific, and North America. Europe was the largest source of GSSS bonds, with a volume of US$405 billion, representing 47% of the total in 2023, while the Latin America and Caribbean (LAC) region accounted for only 6% of the total.

This disparity among regions underscores a significant investment gap in the capital flows needed for low-carbon development and enhancing climate adaptation and resilience, especially in less-developed geographies, such as LAC countries. This situation also presents an opportunity to leverage the vast, untapped market for GSSS bonds to address the LAC region’s ESG challenges.

The LAC region is well-positioned to unlock the potential of GSSS bonds for several reasons. The issuance of GSSS bonds can be integrated with the LAC countries’ public policies and international commitments to accelerate climate change mitigation, energy transition, biodiversity protection, sustainable development, and social equality. Several countries in the region, including Brazil, Colombia and Mexico, have issued national ESG-related policies and taxonomies or roadmaps for issuers in their countries to implement in the GSSS bonds.

GSSS bonds can finance projects in strategic sectors (e.g., transportation, energy, water supply, food security), which are critical for LAC countries, while protecting a region that hosts 40% of the world’s biodiversity, 10% of its coral reefs, 12% of its mangrove forests, and significant reserves of critical minerals essential for the energy transition (the LAC region produces 40% of the world’s copper and 35% of its lithium).

Moreover, international GSSS bonds are a highly effective path for supporting emerging capital markets, particularly for ESG projects that are capital-intensive and long-term in nature, and often require foreign technologies. These bonds typically adhere to criteria and principles established by reputable international organizations, including the ICMA and the Climate Bonds Initiative. These frameworks provide comprehensive benchmarks and guidance for corporations, sovereigns, sub-sovereigns, and state-owned entities committed to sustainability.

In light of the significant opportunities in the LAC region for energy transition and critical minerals, Sociedad Química y Minera de Chile S.A. (SQM), a global leader in lithium production, completed a US$750 million green bond offering in 2023. These bonds were offered in the United States to qualified institutional buyers pursuant to Rule 144A under the U.S. Securities Act, and internationally pursuant to Regulation S under the U.S. Securities Act. This transaction exemplifies how LAC companies can enhance their presence in the sustainable market, with SQM building on its successful US$700 million inaugural green bond offering completed in 2021.

The proceeds from the green bonds will be used by SQM to finance or refinance eligible green projects within two primary categories related to the expansion of lithium carbonate production in Chile. These projects are selected by a management control unit comprised of senior executives. First, clean transportation projects will involve expenditures dedicated to lithium extraction and processing for the manufacture of batteries for electric vehicles. Second, energy efficiency projects will encompass expenditures dedicated to lithium extraction and processing for the manufacture of batteries for energy storage.

Another notable example is Grupo Energía Bogotá S.A. E.S.P. (GEB), one of the largest Colombian state-owned energy companies, which, in 2023, successfully issued its inaugural US$400 million sustainability bond. This groundbreaking issuance made GEB the first Colombian company to issue sustainability bonds in the international capital markets pursuant to Rule 144A and Regulation S under the U.S. Securities Act.

The GEB offering illustrates the versatility of sustainable bonds, as net proceeds will finance both green and social projects. Eligible green projects include expenditures in pollution prevention, renewable energy, energy efficiency, climate change adaptation, circular economy, and biodiversity protection, while eligible social projects involve expenditures focused on socioeconomic advancement, diversity and inclusion programs (e.g., women’s empowerment programs), and access to essential services and basic infrastructure.

Conclusion

The GSSS bond market has shown consistent growth year by year, driven by increasing comfort among issuers, rising demand from investors, and supportive policy incentives. Green bonds are currently the leading structure, aligning with environmental goals while maintaining flexibility for operating companies. These sustainable finance instruments offer viable alternatives for debt refinancing, particularly in high-interest rate environments, and present significant opportunities in regions with substantial natural resources and ESG challenges, such as LAC. GSSS bonds have the potential to promote global economic sustainability, but standardizing ESG reporting criteria and taxonomies remains a challenge in many countries.

This entry has been created for information and planning purposes. It is not intended to be, nor should it be substituted for, legal advice, which turns on specific facts.