Client Alert

Accelerating Equity and Cash Incentives May Create Valuable Permanent Tax Savings

Client Alert

Accelerating Equity and Cash Incentives May Create Valuable Permanent Tax Savings

December 18, 2017

Tax Bill Procedural Overview

Tax reform took another step forward on Friday, December 15, 2017, when the House and Senate released a joint version of the Tax Cuts and Jobs Act (the "Tax Bill"). While this final version of the Tax Bill must still be passed by both the House and Senate and signed by the President, many believe the Tax Bill has enough momentum to become law before the end of the year. Additionally, many, if not most, provisions will be effective starting January 1, 2018. Further, it appears that a hallmark part of this legislation will be up to a 14% cut in the top entity level tax rate for many corporations. The speed at which the Tax Bill is being moved through both chambers of Congress means that employers wanting to adopt tax efficient strategies must do so at a similar accelerated pace.

How Sophisticated Employers Can Improve Their Bottom Line and Save Cash by Accelerating Incentives

In light of the looming reduction in the corporate tax rate, employers may wish to accelerate the deductibility of cash and equity incentive compensation from 2018 to 2017. This acceleration would apply with respect to cash and equity incentive compensation that is scheduled to vest, settle or be paid within two and half months following the close of the 2017 tax year.

In general and for most corporations, the Tax Bill proposes a flat 21% federal income tax rate on a corporation’s taxable income (previously this tax rate could go up to 35%). Due to this reduction in the tax rate, accelerating deductions into 2017 may provide a valuable permanent tax savings for many corporations. Below is an illustration of the potential tax savings as a result of accelerating deductions from 2018 to 2017 for a corporation that has a marginal federal income tax rate of 35% in 2017 and assuming that (i) $50 million of cash and equity incentive compensation deductions can be accelerated from 2018 to 2017 and (ii) the Tax Bill is passed in its current form.

| Incentive Deduction Tax Savings Example (Most C-Corporations) | ||

|

2017 | 2018 | |

| Incentive Compensation | $50,000,000 | $50,000,000 |

| Marginal Tax Rate | 35% | 21% |

| Value of Tax Deduction | $17,500,000 | $10,500,000 |

| Potential Tax Savings | ||

| 2017 Tax Deduction | $17,500,000 | |

| 2018 Tax Deduction | $10,500,000 | |

| Potential Tax Savings | $7,000,000 | |

Material Gatekeeping Factors to Consider

The following are gatekeeping items to consider in determining whether accelerating equity or cash based compensation may be right for your company:

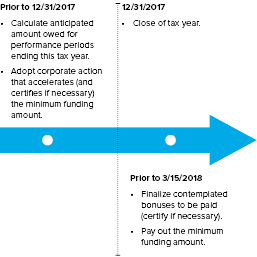

- Ability to Accelerate: In order to take advantage of this potential tax savings, the compensation committee or other governing body of the corporation would need to adopt a corporate action, prior to and effective as of the close of the 2017 tax year to irrevocably commit the employer to funding a certain minimum amount of incentive compensation that is otherwise scheduled to be paid by March 15, 2018 (for calendar year taxpayers).

- Taxable Income or Ability to Utilize NOLs: Employers wanting to utilize this deduction should have taxable income in 2017 or otherwise have the ability to utilize net operating losses.

- Cash versus Equity: The ability to accelerate a deduction for cash incentive compensation is well-established and fairly straight forward, as compared to stock settled incentive compensation. However, the deduction acceleration for stock-settled incentive compensation may have additional accounting, tax (for both the employee and employer) and proxy disclosure wrinkles that would need to be considered. Companies should consult with legal and accounting experts before accelerating equity compensation.

- Future 162(m) Performance-Based Exclusion Implications: Currently, the Tax Bill proposes that any performance-based compensation subject to a written binding contract that is in place by, and not materially modified after, November 2, 2017 would otherwise continue to be eligible for exemption under Section 162(m) of the Internal Revenue Code. Therefore, companies way want consider whether the approach would be beneficial for incentive awards with performance periods that do not end in 2017.

If your company is a good candidate for incentive acceleration based on the aforementioned factors, please see below for high level action steps to take that are intended to accelerate the potential deduction.

High Level Action Steps to Accelerate Deduction (Calendar Year Taxpayer)

Winston Takeaway

For employers that want to adopt tax efficient strategies accelerating incentive deductions into the current tax year may create valuable tax savings opportunities.

We will continue to monitor developments on this front and will provide timely updates as events unfold.