Article

Equity Rights Offering Considerations As Maturity Cliff Looms

Article

July 15, 2024

This article was originally published in Law360. Reprinted with permission. Any opinions in this article are not those of Winston & Strawn or its clients. The opinions in this article are the authors’ opinions only.

To address liquidity shortfalls during the COVID-19 pandemic, many public companies incurred significant debt, and particularly convertible debt. With a substantial amount of these COVID-era debt issuances maturing between 2025 and 2028, a so-called maturity cliff is now looming.

While some companies’ financial prospects have improved since the pandemic, other companies remain in financial distress and must undertake low-cost capital raising transactions to address significant upcoming maturities.

In determining the optimal type of transaction to execute, such companies must consider exogenous factors, such as (1) current macroeconomic headwinds — i.e., high inflation and high interest rates — and (2) geopolitical events, such as the upcoming U.S. presidential election, and resulting market volatility and uncertainty.

In light of prevailing macroeconomic headwinds, debt financing may be costly and otherwise inopportune. Equity financings requiring extensive marketing may be difficult to execute or unsuccessful due to market volatility in the lead up to the U.S. presidential election in November.

This article discusses why fully backstopped, nontransferable equity rights offerings — which are called rights offerings in this article and involve an affiliate backstop investor, as defined herein — are advantageous financing tools for distressed companies seeking to address significant upcoming maturities in the current market landscape.

Although historically used by (1) foreign private issuers and (2) domestic issuers in the context of bankruptcy, these rights offerings are gaining traction among distressed domestic issuers outside of bankruptcy. Nevertheless, rights offerings are still less common compared to other types of financings.

Overview

Rights offerings are U.S. Securities and Exchange Commission registered public offerings wherein a company distributes to existing shareholders — eligible shareholders — as of a fixed record date, on a pro rata basis and at no charge, subscription rights to purchase additional shares of the company’s outstanding common stock at a discounted price.

Eligible shareholders who wish to participate must subscribe for shares during the subscription period, which typically lasts 30 days, subject to certain exceptions. Participating eligible shareholders must submit payment for shares before the expiration date of the rights offering, or the expiration date.

Rights offerings involve a backstop investor contractually obligated to purchase all unsubscribed shares following the expiration date — or backstop shares — thereby ensuring a successful outcome. Backstop investors typically consist of company affiliates or investment banks.

Engaging an affiliate has several benefits. First, an affiliate may obviate the need for costly backstop commitment fees because such affiliate is incentivized to participate due to its existing ownership stake in the company.

Second, in the case of Nasdaq-listed issuers, engaging an affiliate as backstop investor may help ensure that the rights offering remains exempt from the rule requiring shareholder approval in the event a company issues greater than 20% of its outstanding common stock at a discount.

To avoid triggering the 20% rule, Nasdaq-listed issuers must structure the backstop commitment so that the backstop investor:

Participates on the same terms as other participating shareholders; and

Is not compensated for its backstop commitment — de minimis reimbursement of the backstop investor’s legal fees is typically not considered compensation.

The Right Stuff in Current Macroeconomic Headwinds

In light of current macroeconomic headwinds, rights offerings are cost-effective capital raising transactions for distressed companies compared to debt financing. Persistent high inflation in recent years has exacerbated the financial condition of companies struggling to recover from the pandemic.

Companies unable to pass supply-chain cost increases along to their customers may need to absorb these cost increases. Consequently, such cash-strapped companies may not have sufficient capital necessary to pay interest expense amid prevailing high interest rates.

Even if debt financing is an option, favorable terms may not be available. For example, companies resorting to high-yield bonds will pay a high coupon to investors and will be subject to various negative covenants restricting their business operations and future financing options.

The Right Stuff Amid Market Volatility and Uncertainty

In light of market volatility and uncertainty stemming from geopolitical events, such as the upcoming U.S. presidential election, announcements from the Federal Reserve regarding interest rates, and the wars in the Middle East and Ukraine, rights offerings are compelling financing options compared to other equity financing alternatives.

Unlike other equity financing options, rights offerings are better insulated from the impact of exogenous events because there is no investor road show in a rights offering as the offering is made only to eligible shareholders.

The participation of the affiliate backstop investor mitigates the risks posed by poor market conditions because such an investor is contractually obligated to purchase all backstop shares, regardless of market conditions.

Issuers have the flexibility to manage unfavorable market conditions by amending the terms of the rights offering at any point during the subscription period.

Rights offerings boost investor confidence and interest despite market turmoil. The participation of an affiliate backstop investor in the rights offering signals to the market that a large shareholder is bullish about a company’s prospects, thereby increasing optimism among other existing investors.

Unlike other equity financing alternatives, rights offerings promote existing shareholder participation because rights offerings minimize dilution.

Existing shareholders are incentivized to participate in rights offerings because their risk of being diluted is less compared to other equity offering structures.

Finally, the customary over-subscription privilege, a feature unique to rights offerings, enhances the offering’s appeal to eligible shareholders interested in increasing their ownership stake.

Disadvantages

Nevertheless, there are some key disadvantages. Rights offerings may implicate certain provisions in existing debt instruments, therefore requiring amendments to such provisions or other measures to ensure compliance.

Additionally, the engagement of an affiliate as the backstop investor may concentrate company ownership, thereby limiting the voting power of minority shareholders.

Certain Preliminary Considerations

Rights offerings require significant preparation. Accordingly, issuers and their counsel should prioritize the following action items.

Select the Affiliate Backstop Investor and Establish Corporate Governance Safeguards

An issuer should first select the affiliate backstop investor, which should retain its own counsel.

The affiliate backstop investor is typically a significant shareholder, a member of a company’s board of directors or an executive officer of the company — each known as a related party.

Given the affiliate backstop investor’s related party status, and the fact that the aggregate value of its backstop commitment will likely exceed the threshold set forth in the company’s related party transaction, or RPT, policy, the backstop commitment will constitute an RPT under the policy.

Thus, to prevent conflicts of interest, a company’s board should delegate approval authority over the material terms of the backstop commitment and the rights offering to a committee consisting of independent, disinterested directors — or the transaction committee.

The transaction committee negotiates and approves the following documents:

The backstop agreement, setting forth the terms of the backstop commitment and the respective rights and obligations of the affiliate backstop investor and the company, including the company’s customary post-closing obligation to file a resale shelf registration statement with the SEC registering the backstop shares; and

The standstill agreement or an amendment to an existing standstill agreement, delineating certain ownership limitations with respect to the affiliate backstop investor following the completion of the rights offering.

During the approval process, the transaction committee should consult with a financial adviser.

Consider Regulatory Regimes

Stock Exchange Requirements

The New York Stock Exchange and the Nasdaq Stock Market require issuers to comply with several rules when structuring and executing a rights offering.

The following is a nonexhaustive list of important topics for the issuer and its counsel to consider:

Minimum length of the subscription period, as the NYSE requires NYSE-listed issuers to hold rights offerings open for at least 16 days, while the Nasdaq does not have a comparable requirement;

Required advance notice for listing additional shares;

Required advance notice of the record date, as both NYSE and Nasdaq require at least 10 days’ advance notice;

The applicability of the 20% rule; and

The applicability of NYSE rules requiring shareholder approval for sales to substantial security holders.

Key SEC Requirements

A number of SEC filings are required to execute a rights offering. The following is a nonxhaustive list of key SEC filings for the issuer and its counsel to prepare:

Registration statement — Form S-1 or Form S-3: The shares issued in connection with the rights offering are registered pursuant to a registration statement on Form S-1 or Form S-3, if an issuer meets Form S-3 eligibility requirements.

Prospectus supplement —This filing updates the base prospectus in the Form S-3 registration statement and details the specific terms of the rights offering, such as the number of shares to be issued, the price and the expiration date.

Engage Third Parties

Issuers typically engage the following third parties: subscription agent, information agent, financial adviser to the transaction committee, auditors and transfer agent.

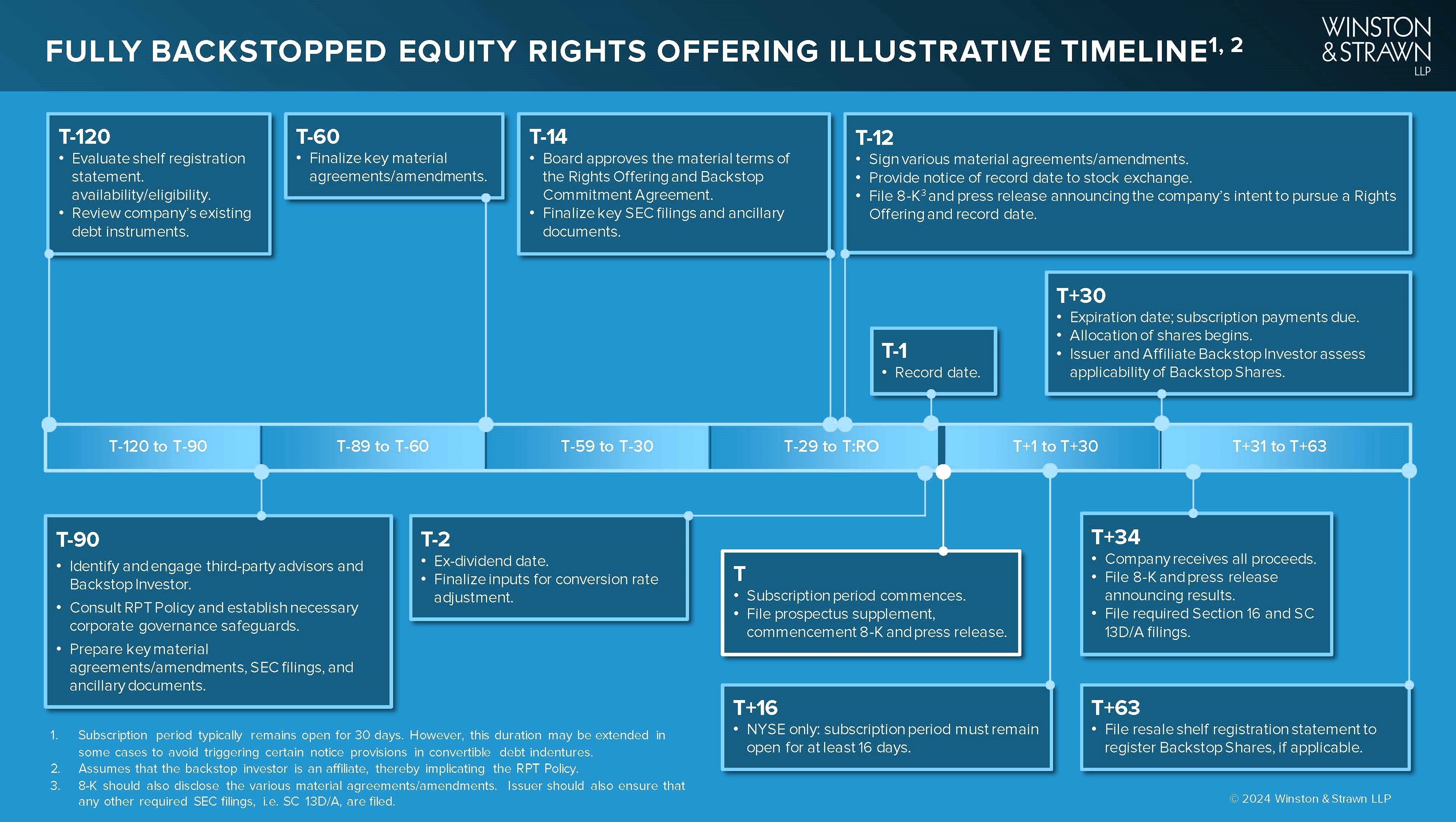

Illustrative Timeline

The below timeline depicts the general sequence of a rights offering involving an affiliate backstop investor.

This timeline assumes that shareholder approval under applicable stock exchange requirements is not required. In devising a timeline, issuers and their counsel should carefully review the applicability of advance notice provisions in convertible notes indentures, if applicable.

Top Five Best Practices

1. Evaluate shelf registration statement availability and eligibility.

Form S-3 eligible issuers should evaluate their shelf registration statement availability — i.e., expiration date and capacity — and eligibility. If necessary, sufficient time should be allocated to modify the existing shelf registration statement in accordance with SEC rules or file a new shelf registration statement with the SEC.

2. Review credit agreement covenants and other key provisions.

The distribution of rights is typically considered a restricted payment; therefore, a credit agreement amendment is often required. Counsel should also review the change-of-control provision when determining the size of the backstop commitment and, if necessary, amend such provision.

3. Analyze convertible notes indenture.

Convertible notes indentures typically contain a customary provision requiring issuers to provide 45 trading days’ advance notice of the rights offering to noteholders and the trustee under certain circumstances.

Counsel should consult with the trustee and trustee’s counsel to assess the applicability of such notice requirement and proceed accordingly. Counsel should also review the applicable conversion rate adjustment formula in the convertible notes indenture as the rights offering will trigger a conversion rate adjustment.

Issuers should retain a financial adviser well in advance of the ex-dividend date to calculate the conversion rate adjustment. Finally, counsel should also review change-of-control and other pertinent indenture provisions when structuring the backstop commitment.

4. Consult stock exchange representatives.

Stock exchange representatives should be consulted to ensure that the rights offering complies with applicable stock exchange requirements. The applicability of the 20% rule and New York Stock Exchange rules requiring shareholder approval for sales to substantial security holders are highly fact-specific determinations.

5. Implement and document corporate governance safeguards.

As discussed earlier, appropriate measures must be implemented to ensure that the backstop commitment complies with the RPT policy. Issuers should prepare resolutions delegating the requisite authority to the transaction committee.

Additionally, issuers should compile a record of the factors the transaction committee and the board evaluated in authorizing the rights offering and the backstop commitment, as they will be required to disclose the same with the SEC.

Conclusion

In light of current macroeconomic headwinds and market volatility and uncertainty resulting from, among other things, the upcoming U.S. presidential election, rights offerings involving an affiliate backstop investor are cost-effective, advantageous capital raising transactions for distressed companies looking to manage their leverage ahead of the maturity cliff.