Client Alert

New UK Corporate Transparency Rules – Disclosure of Persons With Significant Control Over UK Companies and LLPs

Client Alert

New UK Corporate Transparency Rules – Disclosure of Persons With Significant Control Over UK Companies and LLPs

March 10, 2016

Overview

With effect from 6 April 2016, new rules which are principally contained in Part 21A of the Companies Act 2006 (as inserted by the Small Business, Enterprise and Employment Act 2015) and the Register of People with Significant Control Regulations 2016 (the “PSC Rules”) will come into place which will require most UK incorporated companies and LLPs to:

- establish and maintain a register (a “PSC Register”) identifying “persons having significant control” (“PSCs”) over them; and

- disclose the PSC Register on their Annual Confirmation statement (the Companies House filing which will replace the current form of Annual Return statement) the first time that return falls due from June 2016 onwards.

A company must keep its PSC Register available for inspection at its registered office or, provided that the necessary notifications have been made to Companies House, other inspection address. Subject to certain safeguards, any person may inspect a company’s PSC Register. From June 2016, a private company will also be able to elect for its PSC Register to be maintained by Companies House only, rather than maintaining it with its existing statutory registers. PSC Register details will also be part of the information required in order to incorporate a new UK company or LLP.

The PSC Rules are intended to increase greater transparency regarding the ownership and control of UK entities and are based on measures from the EU’s Fourth Money Laundering Directive which is due to be implemented by all member states by June 2017.

Who is required to maintain a PSC Register?

The new regime applies to all UK incorporated companies and LLPs but does not apply to overseas entities or UK entities with a stock exchange listing on certain markets, including the London Stock Exchange, AIM or those admitted to trading on a regulated market in an EEA state, as information on their significant shareholders is already disclosed to the public under existing UK and EU transparency rules. UK companies listed on all principal markets in Japan, the USA, Switzerland and Israel are also exempt as they are deemed to have sufficiently similar disclosure regimes.

A UK company which is a subsidiary of a company listed on any of the above referenced stock markets will still need to comply with the PSC Rules and maintain a PSC Register. However, in preparing the PSC Register, it will not need to look above the listed parent company.

Who must be included on the PSC Register?

Individuals

The main object of the PSC Rules is to ensure that a UK company or LLP discloses those individuals with significant control over it, any such individual being a PSC. A PSC of a UK company or LLP is defined as any individual (regardless of nationality and residency) who satisfies at least one of the following criteria:

- directly or indirectly holds more than 25 percent of the company’s shares;

- directly or indirectly holds more than 25 percent of the company’s voting rights;

- directly or indirectly holds the right to appoint or remove a majority of the company’s directors;

- otherwise has the right to exercise, or actually exercises, ‘significant influence or control over the company; or

- has the right to exercise, or actually exercises, significant influence or control over the activities of a trust or firm which is not a legal entity, but would itself satisfy any of conditions (i) through (iv) above if it were an individual.

Accordingly, any individual who satisfies the above criteria directly should be registered by a company or LLP on its PSC Register.

Legal entities

The PSC Rules acknowledge that an individual can satisfy the above criteria indirectly through a chain of companies. In such circumstances, it will normally be the details of the “relevant legal entity” (“RLE”)which must be entered into the particular company’s PSC Register, instead of the individuals.

A RLE is a legal entity which:

- would satisfy the conditions for being a PSC if it was an individual; and

- is required to keep a PSC Register or satisfies disclosure requirements which have been deemed “equivalent”.

Broadly, this means that UK companies, UK LLPs and non-UK companies with voting shares admitted to trading on certain stock markets will be RLEs, and can be entered on a company’s PSC Register. However, unlisted non-UK companies will not usually be RLEs, and cannot be entered on a company’s PSC Register.

Identification of PSCs and enforcement of the PSC Rules

A company must take “reasonable steps” to identify its PSCs or registrable RLEs. There is no exhaustive list of steps which must be taken, but when a company does not already have the information it needs, it must give a formal notice to anyone it knows or believes to be a PSC or registrable RLE asking them to confirm the nature and extent of their interest.

A UK company also has statutory power to serve a notice requesting information on anyone that knows, or that it suspects may know, the identity of a PSC or registrable RLE (or of someone likely to have that knowledge). This power can be used, for example, to require foreign entities in an ownership chain to provide details of any registrable RLEs or PSCs further up the chain who should be recorded on a company’s PSC Register. A company must keep its PSC Register up to date.

When it knows or suspects that the information on its register has changed, it must take steps to verify the changes. There are criminal sanctions for companies and their officers if they fail to comply with these duties, and for those who fail to respond to a company’s request for information.

In addition to criminal sanctions, there is an onerous default process to help ensure compliance with the PSC regime: a company can apply “restrictions” to shares or interests held by any person or legal entity who, without a valid reason, repeatedly fails to respond to its requests for information. Such restrictions effectively “freeze” their interests in the company until the information is received - so, they cannot sell, transfer or receive any benefit from their interests (including dividends) during the restricted period. A company may need to impose such “restrictions” to satisfy its obligation to take “reasonable steps” to identify its PSCs/registrable RLEs.

What information is required to be included on the PSC Register?

The information that must be included on the PSC Register is as follows:

| Individuals | RLEs | |

| Full name | Corporate name | |

| Service and residential address (residential address will not be publicly available) | Registered/principal office | |

| Nationality and country or state of residence | Legal form and governing law | |

| Date of birth | Applicable companies register and registration number | |

| Date became registrable on the PSC Register | Date became registrable on the PSC Register | |

| Nature of control (i.e. which of the specific criteria above has been met) | Nature of control (i.e. which of the specific criteria above has been met) |

Implications on corporate and private equity structures

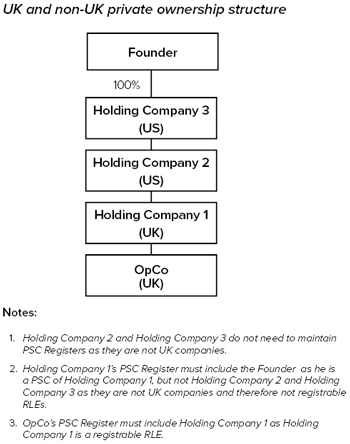

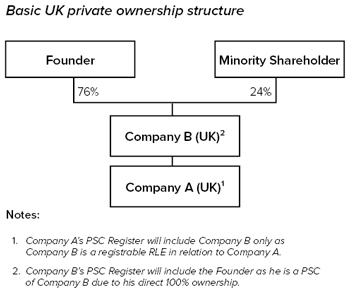

Corporate structures

In a group situation, the effect of the PSC Rules is that it will not usually be necessary to put the individual(s) who ultimately control the group on the PSC Registers of all UK entities in the corporate chain. However, the provisions aim to ensure that it is possible to follow the ownership chain up to the ultimate individual PSC(s) (if any). Below are some worked examples showing this.

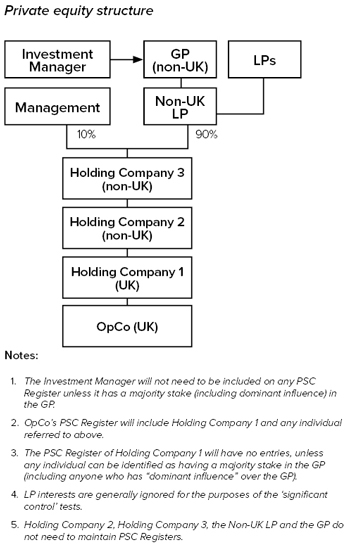

Private equity structures

Many private equity funds will be established as limited partnerships. An individual who is a limited partner in (or who controls a limited partner in) a limited partnership will not qualify as a PSC under criteria (i) to (iii) of the PSC criteria above by virtue only of being (or controlling) a limited partner. Therefore, unless the limited partner has the right to exercise or actually exercises significant influence or control over the UK Company, he is unlikely to qualify as a PSC.

What should your company do?

- UK companies or LLPs which are subject to the new requirements, or overseas companies which have a subsidiary or investee company which is a UK company, must establish a PSC Register alongside their existing statutory registers by 6 April 2016.

- UK companies or LLPs which are subject to the PSC Rules should review their register of members and constitutional documents to identify people whose shareholding or voting rights are more than 25%.

- Individuals who have direct or indirect interests in a UK company or LLP should take steps now to ascertain whether or not they will be a PSC and any such PSC should liaise with the underlying UK company or LLP to ensure that it establishes and maintains a PSC Register or such individual should re-organise his affairs by 6 April 2016 that they do not need to be registered.

- If you receive a notice from a UK company or LLP seeking information under the PSC Rules, ensure that the requested information is provided within 30 days to avoid committing a serious criminal offence and if in any doubt as to how to respond seek prompt legal advice.