Client Alert

Participating Loans and Subordinated Bonds, the new government-backed programme to support French companies

Client Alert

Participating Loans and Subordinated Bonds, the new government-backed programme to support French companies

April 13, 2021

- The newly constituted prêts participatifs (Participating Loans) and obligations subordonnées (Subordinated Bonds) form part of the French government’s recovery plan and, from this April 2021, are set to take over the French State-backed loans, the “prêts garantis par l’Etat”, or PGEs (without replacing them) in terms of additional funding available to French small and mid-size companies (SMEs and ETIs). The Decree No. 2021-318 setting out the specific rules has been published on 25 March 2021 (the Decree).

- By way of reminder, Participating Loans are repayable after all other debts of a company have been repaid, and thus rank just above equity, without any dilution for the company.

- Participating Loans and Subordinated Bonds will be available from April 2021 until 30 June 2022. French companies can choose between:

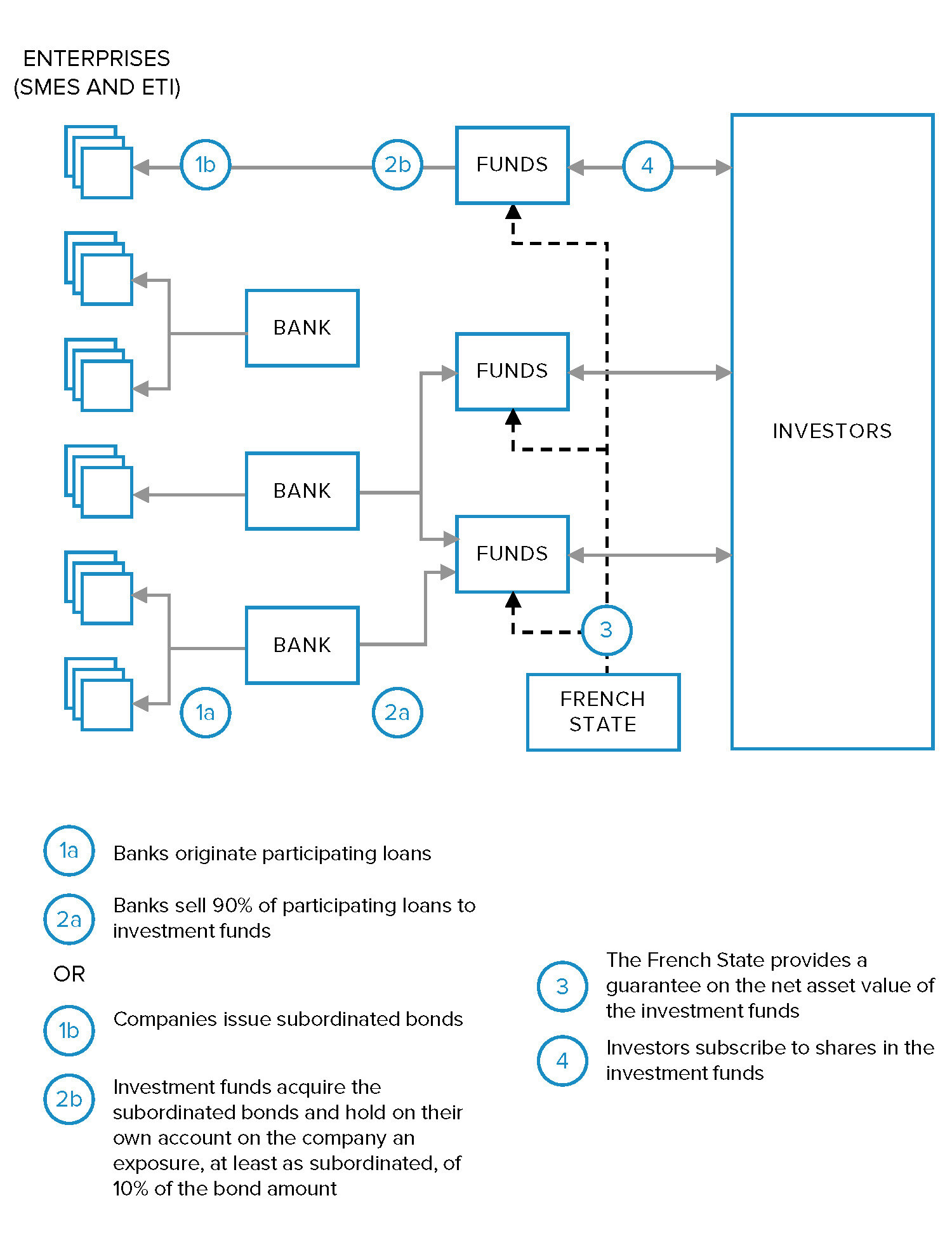

- a Participating Loan granted by credit institutions (i.e. non-funds) and finance companies. 90% of these loans will then be assigned (in the form of assignment of receivables) to alternative investment funds raised solely for the purpose of ″investing in Participating Loans or Subordinated Bonds” (Eligible AIFs). Institutional investors can then subscribe for units in these Eligible AIFs.

- Subordinated Bonds issued by such companies and subscribed for by Eligible AIFs. The investment fund managing such Eligible AIF (or its delegate or holding entity), will retain on its own account an exposure of 10% of the amount of the bonds. Institutional investors can then subscribe for units in these Eligible AIFs.

- The State guarantee covers 30% of the receivables acquired by Eligible AIFs (but does not cover the abovementioned 10% exposure retained by the management company regarding the Subordinated Bonds). In order to benefit from the guarantee, the Eligible AIFs must submit a request to the French Treasury (direction générale du Trésor) in order to enter into an agreement with the State.

Source : Ministère de L’Economie, des Finances et de la Relance

- Conditions:

- Purpose: the proceeds of the funds must be applied to finance a business plan or an investment and cannot be used to repay existing indebtedness.

- Interest rate will be set out in the agreement. The Decree does not set an applicable interest rate. Market players foresee an interest rate of 4 to 5.5% for SMEs and 6% for ETIs (to be compared with the rates charged for PGEs as recalled below).

- Maturity:

- repayment of Participating Loans is deferred to the 4th year and the final maturity is 8 years.

- similarly, the Subordinated Bonds must be repaid on the 8th year from subscription.

- Eligible companies are French SMEs and ETIs that meet the following criteria:

- a turnover of more than 2 million euros for year 2019;

- a satisfactory credit rating demonstrating their capacity to honour their financial commitments (however the Decree does not specify the required credit rating and refers to the agreement to be entered into between the State and the Eligible AIFs); and

- as of 31 December 2019, the company shall not be subject to a judicial liquidation proceeding or be in the observation period of a safeguard or reorganisation/receivership proceeding (except if a safeguard or reorganisation plan has been ordered by a court before the date the Participating Loans have been granted or the Subordinated Bonds have been issued).

- Amount:

- The amount of Participating Loans and Subordinated Bonds will be equal to:

- for SMEs: 12.5% of the company’s 2019 turnover; and

- for ETI: 8.4% of the company’s 2019 turnover.

- If the company has already benefited from a PGE, it can be combined with the Participating Loans or Subordinated Bonds. However, should the cumulative amount with the outstanding PGE represents more than 25% of the company’s turnover for the year 2019, the available amounts of Participating Loans and/or Subordinated Bonds are reduced to:

- for SMEs: 10% of the company’s 2019 turnover; and

- for ETI: 5% of the company’s 2019 turnover.

- in addition, and only if the company has already benefited from a PGE, the company will have to demonstrate additional conditions i.e. show a decrease of its turnover or the decrease in its activities and investments and must comply with a debt (including Participating Loans or Subordinated Bonds) to equity ratio of less than 5 and the amount of the Participating Loans or Subordinated Bonds must be less than half of its equity.

- The amount of Participating Loans and Subordinated Bonds will be equal to:

- Subordination:

- Legal subordination for Participating Loans: Participating Loans will not be considered as “debt” per se but rather quasi-equity, as they are only reimbursed after complete repayment from all other privileged or unsecured creditors in the event of amicable liquidation or insolvency proceedings (article L. 313-15 of the French Monetary and Financial Code).

- Contractual subordination for the Subordinated Bonds: the Subordinated Bonds must be contractually subordinated pursuant to the Decree.

- Other points to note:

- Participating Loans: under the Decree, any Eligible AIF may apply for the State guarantee under a Participating Loan. However an article published in the French newspapers Les Echos indicated that certain insurance companies intending to invest in these loans via a fund would have already chosen the Eurotitrisation management company for the management of the Eligible AIFs intended to acquire the corresponding credit lines:

- loans of less than 10 million euros will be placed in this fund managed by Eurotitrisation. This fund will be divided into several compartments with sub-compartments attached to each bank for which management companies chosen by such banks will be appointed.

- loans exceeding 10 million euros will be analysed by the banks granting the financing alongside a management company (“four-eye analysis”). The selected management companies are: Amundi, Eiffel IG, Capza, BNP Paribas AM, Tikehau and Aviva Investors France.

- Participating Loans: under the Decree, any Eligible AIF may apply for the State guarantee under a Participating Loan. However an article published in the French newspapers Les Echos indicated that certain insurance companies intending to invest in these loans via a fund would have already chosen the Eurotitrisation management company for the management of the Eligible AIFs intended to acquire the corresponding credit lines:

- Subordinated Bonds: the launch of the bonds is estimated for mid-May 2021. Forty funds should be selected to invest 6 billion euros in the form of bonds (cf. Les Echos).

PGEs remain available

- As a reminder, PGEs are still available - any eligible French company can apply for a PGE until 30 June 2021.

- In March 2021, a majority of borrowers have decided to postpone the first repayment of the PGE (repayment was due twelve months after signing the original PGE, subject to deferral options). Borrowers have the option of requesting an additional deferred repayment period in order to begin repaying the loan in April 2022 (with an amortisation schedule to be agreed). The total repayment term remains at 6 years.

- For PGEs granted since 25 March 2020, the pricing conditions for SMEs are as follows:

- rate of 1 to 1.5% for loans repaid by 2022 or 2023 (between one and three years after the PGE is made available);

- rate of 2 to 2.5% for loans repaid by 2024 or 2026 (between four and five years after the PGE is made available).

- All of these rates include the cost of the State guarantee.